Portfolio Allocation Updates (October 2020) - REITs and Property Crashed!

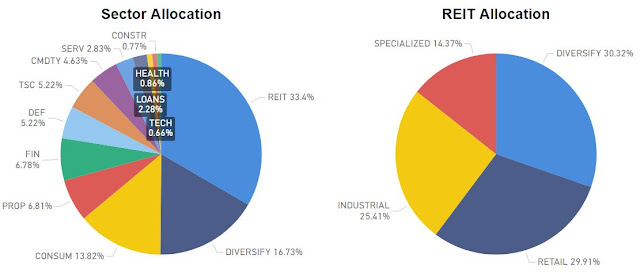

Core Stock Allocation

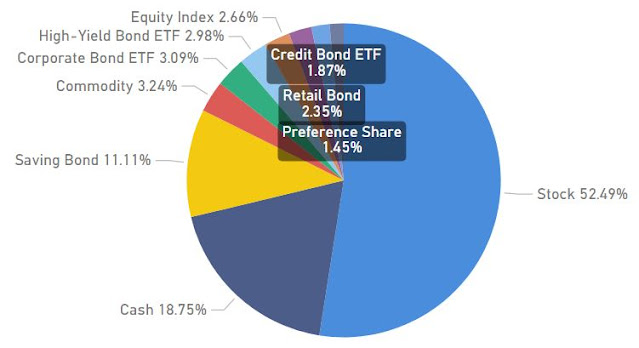

Total Portfolio Allocation

- APPLIED PARTIAL FRASERS CENTREPOINT TRUST PREFERENTIAL OFFERING

- BOUGHT FRASERS CENTREPOINT TRUST

- BOUGHT MAPLETREE LOGISTICS TRUST

- BOUGHT ASCENDAS REIT

The month of October started off well, and markets are fluctuating up and

down based on the progress of negotiations for stimulus. Unfortunately, no

deal was reached in the end and the stimulus package will have to wait

until the US election is over. Market started to retrace with heavy

selling in the last 2 days of the month. It was quite an eventful month

for me.

In the middle of the month, I had to decide on whether to take up the

preferential offering by Frasers CentrePoint Trust, and ended up choosing

only to take up partially. This is due to the price of FCT falling below

the PO price after market closes on a few of the days and the first time I

took partial rights. This eventually turned out to be bad buy as the price

continued to sell down heavily on the last few days of the month.

Although the US election and the US COVID situation by right should not

affect Singapore, there were heavy selling in the local market especially

for REIT and Property counters. Not even the industrial and logistic

trusts are spared in this sell down. STI was broadly down as well.

I ended up doing panic buying and all my queues got filled. I bought more

FCT to average down my PO purchase. I also bought Ascendas REIT. What is

interesting is that Mapletree Logistic Trust went below the upcoming PO

price of $1.99. So, I also ended up buying MLT off the open market. This

means that I will not take part in the PO, which by the way is a miserable

19 new units for 1000 existing units.

With 3 purchases and 1 PO in a single month, I guessed I am pretty

overbought and will not be buying until the US election is over. If the

markets continued to fall after election, I will probably have to empty

out my warchest. Hopefully, there be will a rebound after the election, or

with the news of Phase 3, so that I can conclude my accumulations for the

year.

InvestingNote Profile: @SingularityTruth

Facebook Page: @SingularityTruth

Comments

Post a Comment